Click

Here to Download PDF Click

Here to Download PDF

|

Accounting for Dry Cleaners

Running a dry cleaning business can be challenging. They are labour intensive and can involve long hours with environmental issues involving potentially harmful perchloroethylene chemicals. As a dry cleaner you obviously need to be familiar with safe handling of these chemicals to protect them from damaging the clothing fabric or the health of your staff.

Dry Cleaners come in a variety of shapes and sizes and while some dry cleaning businesses operate 7 days a week and offer a full function service, others simply act as a ‘drop off’ centre where the garments are collected and shipped off to a commercial wash plant for processing. Some operators offer a mobile pick-up and drop-off service that obviously require transportation as well as reliable drivers. If you run a retail shop front then there are additional challenges including extended trading hours, council regulations and inflated rents.

Of course, if you are a full function dry cleaner you need to invest heavily in high end machinery, equipment and chemicals. On the other

hand, the drop off centres are able to operate without expensive commercial wash equipment because no cleaning is done on-site. The

machinery might include dry cleaning baths like washers, a dryer and pressing equipment plus you’ll also need sorting bins, hanger

lines and garment coverings. Machinery down time can have a huge impact on productivity and profitability so the reliability of your dry

cleaning machinery, boilers and shirt laundry equipment is critical. If you’re contemplating buying an existing dry cleaning business,

make sure you have technicians inspect the equipment before purchase as part of your due diligence process.

The dry cleaning market is almost recession proof because as long as people wear clothing that requires special care, there will be a demand

for dry cleaning services. While failure rates are relatively low, the dry cleaning business is certainly not immune to failure. Location is

obviously important and you need a space big enough to accommodate your machinery and equipment plus a storage area for the chemicals. For

maximum productivity you need an efficient layout including areas for reception and pick-up, sorting, the dry cleaning machines, an area for

pressing, hanging and labelling clothes and a packaging area.

The dry cleaning market is almost recession proof because as long as people wear clothing that requires special care, there will be a demand

for dry cleaning services. While failure rates are relatively low, the dry cleaning business is certainly not immune to failure. Location is

obviously important and you need a space big enough to accommodate your machinery and equipment plus a storage area for the chemicals. For

maximum productivity you need an efficient layout including areas for reception and pick-up, sorting, the dry cleaning machines, an area for

pressing, hanging and labelling clothes and a packaging area.

MARKETING YOUR DRY CLEANING BUSINESS

While referrals and the physical location of your business (with lots of foot traffic) remain an important source of new business for dry cleaners, you also need to focus on your online prescence. Increasingly local searches like ‘dry cleaner Perth’ is driving significant traffic to your website. In effect, your website is your silent salesperson open 24/7 and in many cases it is the first touch point with a potential new customer. As you know, you only get one chance to make a good first impression.

One of our biggest points of difference compared to traditional accounting firms is our marketing expertise. We can assist you with your branding (business name, logo and slogan) and help you harness the power of social media to win more referrals. Over the past few years we have worked with dozens of clients to help them create affordable, quality, lead generation websites and if you need advice and assistance with your website content or video production we can help you. Not only that, if your website lacks calls to action or lead magnets we'll help you build them plus we'll introduce you to strategies like re-marketing and search engine optimization to drive more traffic to your site.

We'll make sure your website is responsive to smart phones and tablets and we strive to give our clients a serious competitive edge by introducing them to some breakthrough marketing strategies. If you aren’t using some of these marketing techniques in your dry cleaning business then it's probably not going to reach its full profit potential.

STARTING A DRY CLEANING BUSINESS

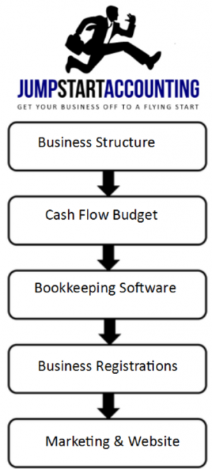

When starting or buying a dry cleaning business there are numerous issues to consider. It can be a minefield but as business start-up specialists we can assist you with everything from your branding through to your business structure, site selection, commercial lease, finance needs, marketing plan and lead generation website.

We have developed a number of tools specifically for new business owners including a comprehensive checklist of start-up expenses. It breaks down your potential establishment costs and splits them into categories including leasehold improvements, marketing, equipment and IT costs. It is very comprehensive so no expense slips through the cracks and these figures then feed through to our cash flow budget template. These tools will help you identify any finance requirements to launch your business and the cash flow budget will tuck neatly into the business plan template we have created for our clients.

As you would expect, we can help you with all your compliance issues like GST, BAS, PAYG and superannuation but experience tells us that bookkeeping and business administration can be hurdles for  most small business owners. To reduce the frustration and fees we will help you select the most appropriate software for your business taking into account your business needs (bookkeeping, payroll, invoicing, point of sale etc.) and level of accounting skill. Where required we will train you or your staff to use the software because in many cases business owners purchase accounting software that is beyond their business needs and level of accounting skill. This can create ‘computerised shoebox’ records and extra accounting costs which conflicts with our mission of helping you minimize the cost of compliance. We are advocates for cloud accounting solutions and work with a number of programs including MYOB, Xero, Reckon and Cashflow Manager.

most small business owners. To reduce the frustration and fees we will help you select the most appropriate software for your business taking into account your business needs (bookkeeping, payroll, invoicing, point of sale etc.) and level of accounting skill. Where required we will train you or your staff to use the software because in many cases business owners purchase accounting software that is beyond their business needs and level of accounting skill. This can create ‘computerised shoebox’ records and extra accounting costs which conflicts with our mission of helping you minimize the cost of compliance. We are advocates for cloud accounting solutions and work with a number of programs including MYOB, Xero, Reckon and Cashflow Manager.

Our services to start-up businesses are both broad and deep. We’ll advise you on the most appropriate tax structure for your new business and in the process, take into account income tax considerations, asset protection, family structures, the likely admission of new partners and eligibility for future discount capital gains tax concessions. If required, we can assist you with your commercial property lease and help you source funding for your new vehicles and equipment (chattel mortgage, lease etc.). Through an affiliate group you also have access to fleet pricing on new cars and light commercial vans that could save you thousands of dollars.

Our services to start-up businesses are both broad and deep. We’ll advise you on the most appropriate tax structure for your new business and in the process, take into account income tax considerations, asset protection, family structures, the likely admission of new partners and eligibility for future discount capital gains tax concessions. If required, we can assist you with your commercial property lease and help you source funding for your new vehicles and equipment (chattel mortgage, lease etc.). Through an affiliate group you also have access to fleet pricing on new cars and light commercial vans that could save you thousands of dollars.

We strive to help you ‘know your numbers’ and that includes understanding the four ways to grow your business. Once you understand the key profit drivers in your business we can talk you through profit improvement strategies and even quantify the profit improvement potential in your business. Of course, this is just the beginning because as accountants we can prepare some ‘what if’ scenarios so you know your best and worst case financial scenarios. Preparing a cash flow budget and projecting your profit and loss is all part of our service offering and we use industry benchmarks to analyse and compare the relative performance of your dry cleaning business against your peers so you understand what is working in your business and what needs working on.

The team at Velocity Accounting Group offer dry cleaners a range of accounting, taxation and business coaching services including:

The team at Velocity Accounting Group offer dry cleaners a range of accounting, taxation and business coaching services including:

- Start-Up Business Advice for Dry Cleaners

- Advice regarding the Purchase or Sale of your Dry Cleaning Business

- Tools including the Start-Up Expense Checklist & Templates for a Business Plan, Cash Flow Budget

- Advice and Establishment of Your Business Structure

- Tax Registrations including ABN, TFN, GST, WorkCover etc.

- Preparation of Business Plans, Cash Flow Forecasts and Profit Projections

- Accounting Software Selection and Training - Bookkeeping, POS, Invoicing and Payroll

- Preparation and Analysis of Financial Statements

- Preparation of Finance Applications

- Bookkeeping and Payroll Services

- Tax Planning Strategies

- Assistance with your Marketing including your Branding, Brochure, Logo etc.

- Assistance with your Website Development, Content and SEO

- Wealth Creation Strategies and Financial Planning Services

- Industry Benchmarking and KPI Management

- Vehicle & Equipment Finance (Chattel Mortgage & Lease of Machinery and Vehicles)

- Advice & Assistance with Pricing your Services

- Advice Regarding Claiming your Motor Vehicle Expenses

- Recession Survival Strategies

- Advice regarding Employee Relations and Workplace Laws

- Business & Risk Insurances (Income Protection, Life Insurance etc.)

- Business Succession Planning

- Break Even Analysis

I n summary, we are so much more than just tax accountants. We are ‘business and profit builders’ who provide strategic advice and practical business solutions that could give you a serious competitive edge in the dry cleaning industry. We work hard to understand your business and over the past decade dry cleaners have become a niche industry within our firm.

n summary, we are so much more than just tax accountants. We are ‘business and profit builders’ who provide strategic advice and practical business solutions that could give you a serious competitive edge in the dry cleaning industry. We work hard to understand your business and over the past decade dry cleaners have become a niche industry within our firm.

If you're an ambitious business owner looking to boost your current results or if you're looking to get your dry cleaning business in Perth off to a flying start we invite you to contact us today. You can expect practical business, tax, marketing and financial advice that could have a profound effect on your future business profits. To book your FREE, one hour introductory consultation simply call us on (08) 9250 4048 or complete your details in the box at the top right hand side of this page and we will be in touch.